Essential Aspects of In-House Plans

In-house plans, also known as employer-sponsored health insurance, are healthcare coverage provided by employers to their employees and their dependents. These plans offer a range of benefits, including:

- Medical care

- Prescriptions

- Dental care

- Vision care

- Mental health care

There are various types of in-house plans, each with its own set of benefits and costs. The most common types include:

- Preferred provider organization (PPO): PPOs allow members to choose from a network of healthcare providers. Members pay lower costs when using in-network providers.

- Health maintenance organization (HMO): HMOs require members to choose a primary care physician (PCP) who coordinates their care. Members can only see specialists if they are referred by their PCP.

- Point-of-service (POS): POS plans offer a combination of PPO and HMO features. Members can choose to see in-network or out-of-network providers, but out-of-network care is more expensive.

The cost of in-house plans varies depending on the type of plan, the size of the employer, and the location of the employer. Employees typically pay a portion of the premium, while the employer pays the rest. In some cases, employers may offer a premium discount to employees who participate in wellness programs or meet other criteria.

There are several advantages to having in-house health insurance. These include:

- Convenience: In-house plans are easy to use because they are administered by the employer. Members don't have to worry about finding a health insurance provider or enrolling in a plan.

- Affordability: In-house plans are often more affordable than individual health insurance plans. Employers can negotiate discounts with providers, and employees may be able to take advantage of premium discounts.

- Tax benefits: Premiums paid for in-house plans are tax-deductible for employers. Employees may also be able to exclude a portion of their premium payments from their taxable income.

However, there are also some disadvantages to having in-house health insurance. These include:

- Limited choice: In-house plans typically offer a limited network of providers. This can make it difficult to find a doctor or specialist who meets your needs.

- Lack of flexibility: In-house plans are not as flexible as individual health insurance plans. Employees may not be able to customize their coverage or choose their own providers.

- Job loss: If you lose your job, you will also lose your in-house health insurance. This can be a major financial burden, especially if you have a pre-existing medical condition.

Overall, in-house health insurance plans can offer a number of benefits to employees. However, it is important to weigh the advantages and disadvantages carefully before enrolling in a plan.

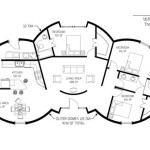

House Plans How To Design Your Home Plan

Floor Plans Types Symbols Examples

House Plans How To Design Your Home Plan

House Plans How To Design Your Home Plan

Small House Design 2024005 Pinoy Eplans Modern Plans Floor

Where You Can Buy House Plans Live Home 3d

House Plans How To Design Your Home Plan

House Plan Plans Architectural And Home Design

Floor Plans Types Symbols Examples

Floor Plan Creator And Designer Free Easy App